advising companies that

help feed the world

our story

Westerra Capital represents companies exclusively in the food, beverage, and agribusiness ecosystem with tailored mergers and & acquisitions (M&A) advisory and debt and equity capital solutions. Our deep sector focus and active market presence support businesses from farm gate to consumer through ever stage of growth.

our capabilities

We Are a Full Service Financial Advisory Firm

Our team comes from leading mid-market and bulge bracket firms, bringing best in class experience and expertise to the middle-market.

Westerra advises founders, families, strategics, investors, and shareholders through transactions across the food, beverage, and agribusiness ecosystem. We work closely with owners to evaluate liquidity options, growth objectives, and legacy considerations, tailoring each process to the goals of the business and its stakeholders.

Our sell-side approach emphasizes thoughtful preparation, targeted buyer outreach, and disciplined execution. We leverage deep sector relationships to engage both strategic acquirers and private equity investors with relevant operating experience. By positioning businesses within the context of broader supply chain dynamics, we help maximize value, optimize deal structure, and achieve outcomes aligned with long-term objectives.

Sell-Side Mergers & Acquisitions Advisory

We advise owners and shareholders through the full sale process, positioning businesses to maximize value and achieve optimal outcomes with strategic and financial buyers

Buy-Side Search

We proactively source and originate proprietary acquisition opportunities that fit a client’s strategic criteria, leveraging deep sector relationships and targeted outreach

Buy-Side Mergers & Acquisitions Advisory

We partner with acquirers to identify, evaluate, and execute strategic acquisitions that align with growth objectives, integration capabilities, and return thresholds

Debt & Equity Capital Markets Solutions

We structure and raise tailored debt and equity capital to support acquisitions, growth initiatives, and recapitalizations across the Food, Beverage & Agriculture value chain

sectors we serve

Upstream

Crop Inputs

Seeds, Crop Nutrition, Crop Protection, Animal Feed & Nutrition, Animal Health, Ag Services, Ag Retail, Ag Equipment, Ag Packaging

Production Agriculture

Permanent Crops, Specialty Crops, Row Crops, Livestock, Proteins, Eggs, Dairy, Aquaculture, Indoor Ag

Midstream

Biologicals & Biostimulants, Genetics, Precision Ag & Digital Farming, Robotics, Automation & Artificial Intelligence, Software & Data, Animal Tech, Novel Proteins

AgTech

Primary Processing

Fruits & Vegetables, Proteins, Dairy, Grains & Oilseeds, Milling, Feed & Byproduct, Ingredient Prep

Downstream

Sweet, Savory, Palatants, Colorants, Fortifying Solutions, Fragrance and Aroma, Design & Development

Ingredients

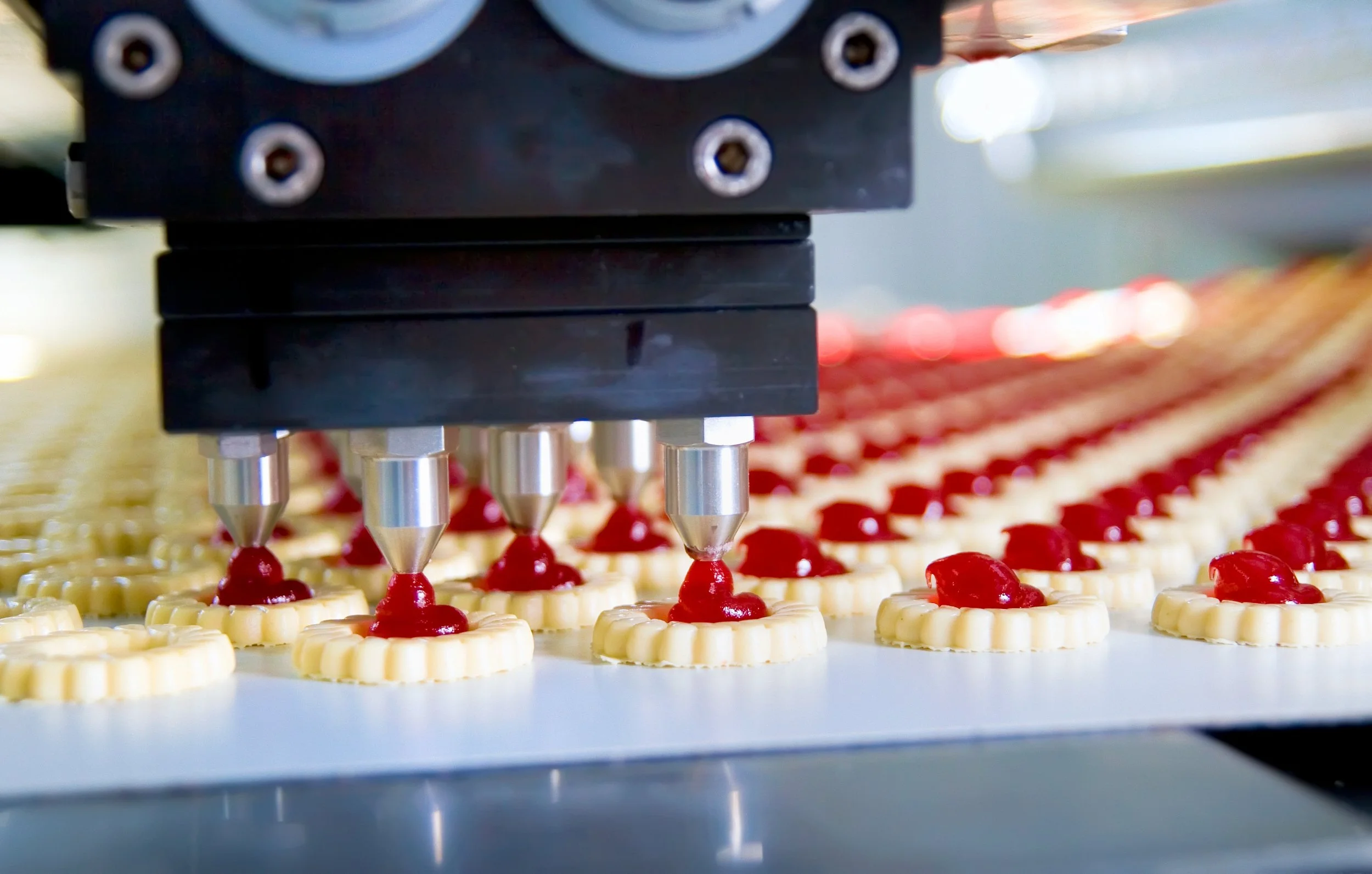

Food & Bev Manufacturing

Contract Manufacturing, Private Label, Food Service, Bakery, Beverage Production, Prepared Foods, Sauces, Value-Added Protein

Packaged Food & Bev

Baking, Spices, Sauces and Condiments, Snacking, Beverage, Frozen Foods

Food & Bev Distribution

Beverage, Dairy, Produce, Proteins, Seafood, Cold Storage, Wholesale, Direct-Store Delivery

companies we’ve worked with

-

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here -

New List Item

Description goes here